Understanding LIRP: How a Life Insurance Retirement Plan Helps You Build Wealth, Protect Your Family, and Fund Your Future

Why LIRPs Are Gaining So Much Attention

Most people are familiar with retirement accounts like 401(k)s, IRAs, and Roth IRAs. But there’s a lesser-known strategy that has quietly become a powerful tool for individuals, families, and business owners who want tax-free income, protection from market losses, and flexible access to money before retirement.

It’s called a LIRP — Life Insurance Retirement Plan.

Unfortunately, many articles online either oversimplify it or criticize it unfairly, often comparing it to investments it was never meant to replace. A LIRP is not a competitor to your 401(k) or Roth—it’s a complement, filling financial gaps no other tool can.

This guide explains what a LIRP really is, how it works, and who it benefits most—plus an example of how it can be used for retirement and college funding at the same time.

What is a LIRP? (In Plain English)

A LIRP is a strategy that uses a max-funded permanent life insurance policy—usually Whole Life or Indexed Universal Life (IUL)—as a tax-efficient vehicle to:

- Grow cash value tax-deferred

- Access money tax-free through policy loans

- Supplement retirement income

- Provide liquidity before age 59½

- Build a tax-free inheritance for your family

- Protect against market downturns (if using an IUL)

A LIRP is not a product—it’s a way of designing and overfunding a cash value life insurance policy so that the primary emphasis is on tax-advantaged accumulation rather than traditional death benefit protection.

When designed properly, the policy becomes:

• A tax-advantaged asset

• A private retirement account

• A personal bank

• A college-funding tool

• A family legacy strategy

All in one.

How a LIRP Works — Simple, Transparent Mechanics

A properly structured LIRP follows this pattern:

1. You contribute premiums above the Target Premium

This builds cash value faster and lowers long-term costs.

2. Your cash value grows tax-deferred

Whole Life grows through guaranteed interest + dividends.

IUL grows based on market index performance—with downside protection.

3. You can access the cash value tax-free

This is done through policy loans, not withdrawals, which means your cash value continues compounding even while you access it. And when this approach is paired with an arbitrage strategy, you can leverage the same dollars to earn two separate returns—one inside the policy and another in an external investment—creating a powerful dual-ROI effect.

4. In retirement, you take systematic loans for income

This creates a tax-free retirement stream because loans are not considered taxable income, if done correctly.

5. When you pass away, the policy pays off any loans and leaves the remaining tax-free death benefit to your family

It is one of the few strategies that:

- Builds wealth

- Provides liquidity

- Protects income

- And creates generational wealth

All at once.

Who Benefits Most From a LIRP?

A LIRP tends to be an excellent fit for:

– High-income earners

Especially those who:

- Expect higher taxes in the future

- Max out their traditional retirement accounts

- Want an additional tax-free income source

– Business owners

Who value:

- Liquidity

- Tax-advantaged growth

- Protection from market volatility

– Families planning for college

Who want:

- Financial aid advantages

- A flexible strategy

- A way around 529 Plan restrictions

– People seeking early access to money

Unlike 401(k)s and IRAs, LIRPs offer access before 59½ without penalties.

– Anyone wanting long-term tax-free income + life insurance protection

A LIRP is a retirement strategy wrapped inside a protection plan.

Common Myths & Misconceptions — The Truth Behind the Noise

Myth 1: “It’s too expensive.”

A LIRP becomes expensive when it’s designed incorrectly and managed irresponsibly.

When structured properly, most of your premium builds cash value—not just protection (insurance).

Myth 2: “It’s worse than a 401(k).”

A LIRP is not a replacement for a 401(k).

It is a different financial vehicle with different rules:

401(k): tax-deductible now, taxable later, market risk

LIRP: after-tax now, tax-free later, market protection

Both have their place.

Myth 3: “Loans are dangerous.”

Policy loans are collateral loans.

They don’t interrupt your growth.

They don’t require credit checks.

And they’re optional.

The key is proper management—which is what your financial professional is there for.

Beyond Retirement: LIRP as a College Funding Strategy

This is where LIRPs truly shine.

• Better FAFSA treatment

Cash value does not count the same way as assets in 529 plans.

Many families qualify for more financial aid.

• No penalties if your child doesn’t attend college

Unlike a 529, your money remains yours.

• Tax-free loans can be used for tuition, housing, books, travel, or anything else.

Complete flexibility.

• The money continues growing even while you borrow from it.

This creates a double effect:

• You maintain full control

The account stays in your name—not your child’s.

For parents who want flexibility and control, LIRP college funding is one of the smartest tools available.

Case Study Scenario

Meet David (Hypothetical Example):

- Age: 40

- Income: $200,000/year

- Wants supplemental tax-free income in retirement

- Wants to help fund his daughter’s college education

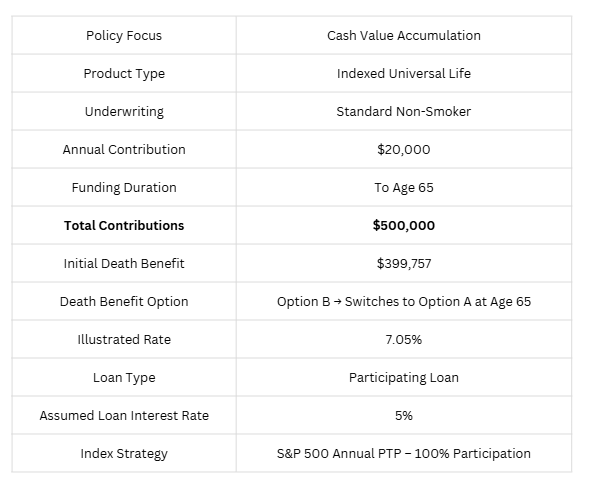

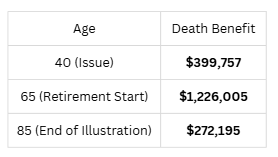

David decides to contribute $20,000 per year into a properly structured IUL, designed specifically for maximum cash value accumulation, not just death benefit protection.

Policy Design Overview

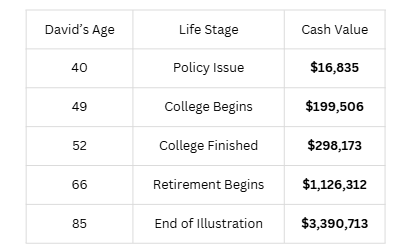

Accumulation Phase:

Over the years, David builds a powerful pool of cash value — while maintaining life insurance protection the entire time.

✅ Key takeaway: Even while using the policy for college and retirement, the cash value continues compounding to over $3 million later in life.

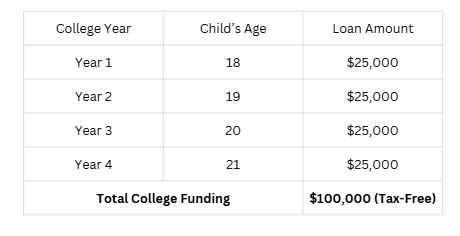

College Funding:

David’s daughter is 8 years old at policy issue, giving him 10 years of growth before college begins. When she turns 18, David uses tax-free policy loans to fund her education — without disrupting his long-term compounding.

✅ Important: Even while these loans are taken, the full cash value continues earning interest, uninterrupted.

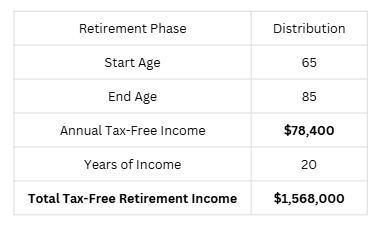

Supplemental Retirement Income:

After college is completed, David continues funding until age 65. At that point, he transitions into tax-free retirement income through policy loans.

✅ This income is not reported as taxable income, because it is accessed through properly structured policy loans.

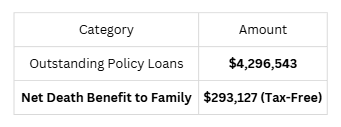

Death Benefit & Legacy Protection:

While David is using the policy during his lifetime, it still maintains a meaningful death benefit.

At life expectancy (age 90):

✅ All outstanding loans are automatically paid off by the death benefit, and David’s family still receives over $293,127 tax-free.

This is the power of a LIRP:

Tax-free income, liquidity, college funding, and generational wealth—all from one strategy.

LIRP vs Traditional Retirement Accounts — Why They Should Work Together

A LIRP is not “better” than a 401(k) or Roth IRA.

It simply plays a different position on your financial team.

401(k)/IRA

- Great for employer match

- Tax-deferred growth

- Requires RMDs

- Penalizes early access

Roth IRA

- Great for tax-free growth

- Income eligibility limits

- Contribution limits

LIRP

- No contribution limits (only MEC guidelines)

- No income restrictions

- Access before 59½

- Tax-free loans

- Market protection (in IULs)

- Legacy benefit built in

Together, they create a diversified retirement plan that works in all economic conditions.

Risks & What to Watch Out For

Like any strategy, a LIRP must be done correctly.

Here’s what clients must know:

- It requires long-term commitment

- Premiums must be funded consistently

- Overfunding must be carefully designed (to avoid MEC status)

- Policy loans must be managed responsibly

- Choosing the right carrier and product matters

- The strategy must be tailored to your specific needs

The LIRP is powerful—but only when crafted by a knowledgeable professional.

Is a LIRP Right for You? Key Questions to Ask

- Do you want tax-free retirement income?

- Do you want access to money before age 59½?

- Do you expect taxes to rise in the future?

- Do you need flexibility with your retirement savings?

- Do you want to protect your downside while still having growth potential?

- Do you want an option that also builds generational wealth?

- Do you want a smarter way to fund college without penalties?

If you answered “yes” to several of these, a LIRP may be a strong fit.

Want to See What Your Numbers Look Like?

A LIRP is not a one-size-fits-all solution.

Your design, your budget, your goals, and your family situation determine everything.

If you’d like to see what a LIRP can look like for you—retirement, college funding, or both—I’d be happy to walk you through the numbers, help you compare strategies, and build a plan that gives you clarity and confidence.

Schedule a personal LIRP review today.

See how this strategy can support your future.

LIRP – Frequently Asked Questions (FAQ)

LIRP stands for Life Insurance Retirement Plan. It uses cash value life insurance to generate tax-free retirement income through policy loans.

No. A LIRP is not a replacement for a 401(k) or Roth IRA—it is a complement. Traditional retirement accounts are regulated by the government, have contribution limits, age restrictions, and future tax uncertainty. A LIRP offers tax-free access through policy loans, no Required Minimum Distributions (RMDs), and liquidity before age 59½.

Policy loans are collateral loans, not traditional debt. They are secured by your own death benefit. As long as they are managed correctly and the policy is properly designed, they are a normal and safe part of the LIRP strategy.

Yes. A LIRP is one of the most flexible college-funding strategies available. Parents can use tax-free policy loans to pay for tuition and expenses, while the cash value continues to grow. If the child doesn’t go to college, the money stays with the parent for retirement or other goals—unlike 529 plans.

Money is typically accessed through policy loans, not withdrawals. When structured properly, these loans are not considered taxable income. In addition, your remaining cash value can continue growing even while you are using it.

It depends on how the policy is structured and how long it has been funded. Some policies can sustain themselves after a certain point using accumulated cash value, while others may require ongoing funding. This is why proper design and annual reviews are critical.

With Whole Life, growth is generally guaranteed and not subject to market losses. With Indexed Universal Life (IUL), there is market participation with a zero floor, which means you don’t lose cash value due to market downturns. However, poor design, underfunding, or excessive loans can create issues—proper planning prevents this.

Not necessarily. While LIRPs are especially powerful for high-income individuals and business owners, the real requirement is consistent disposable income and a long-term mindset—not just net worth.

No ethical professional should ever guarantee outperformance. A LIRP is not designed to compete with aggressive market investing—it is designed to provide tax efficiency, stability, liquidity, and predictable retirement income, while also protecting your family.

The next step is a personal strategy review, where your income, goals, time horizon, and funding capacity are evaluated. From there, a custom illustration can show how a LIRP could work specifically for you.

Estimated reading time: 10 minutes